Don’t Miss Out on Year-End Real Estate Tax Benefits

As the year comes to a close, many investors are focused on finishing strong — but the smartest ones know that how you end the year matters just as much as your returns. Real estate investing offers powerful tax advantages that can dramatically reduce your taxable income before December 31 by tens of thousands of dollars.

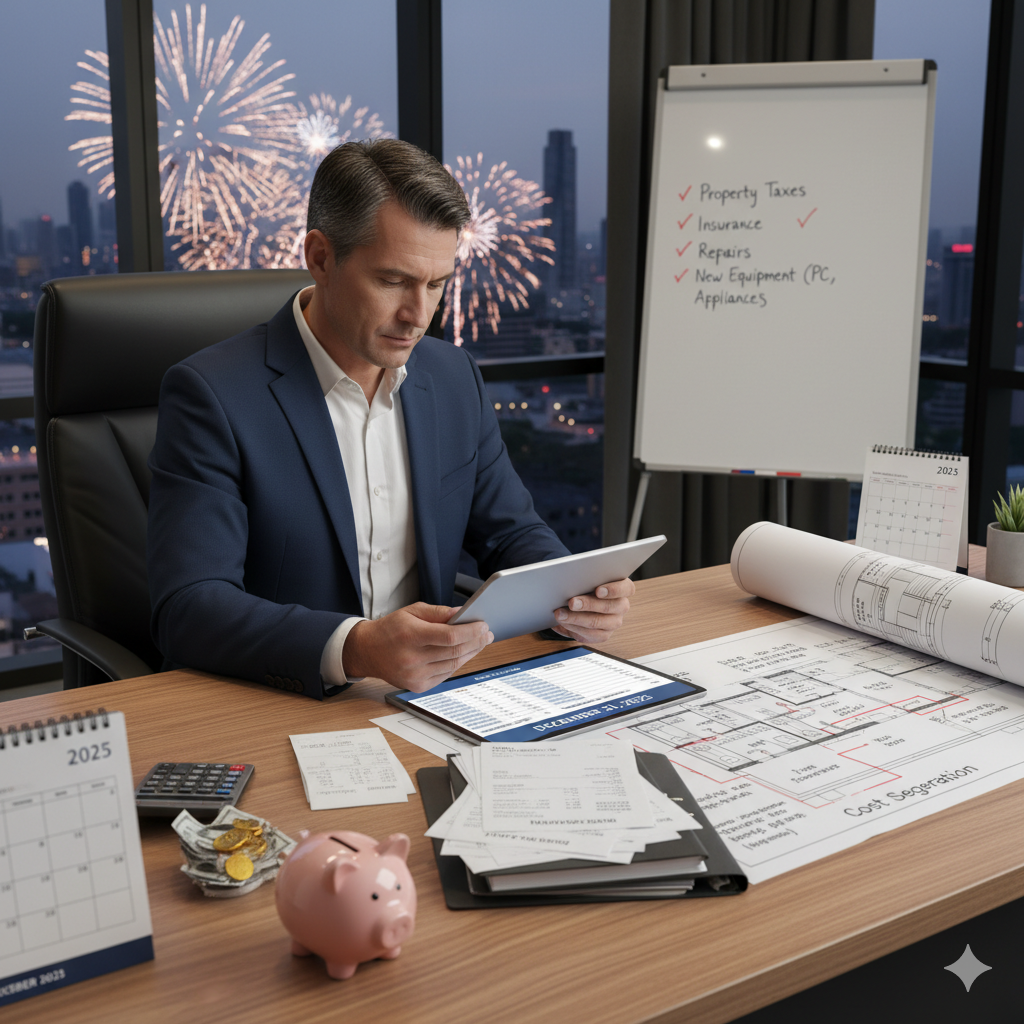

Real estate investors have multiple year-end strategies to reduce their taxable income, including accelerating expenses, maximizing depreciation, and leveraging new provisions introduced for 2025. Key moves often involve timing income and expenses and understanding the implications of recent tax law changes

Immediate year-end tax strategies for 2025

Accelerate expenses into the current year

-Cash-basis taxpayers can time their expenses to reduce their current year's taxable income. Consider paying certain costs in December instead of January.

-Prepay expenses: Pay property taxes, insurance premiums, and other bills before December 31st to deduct them for the current tax year.

-Make repairs and purchases: Complete any necessary property repairs by year-end. You can also purchase new equipment, such as computers or appliances, to deduct the costs.

Maximize depreciation deductions

-Bonus depreciation: For qualified property placed in service in 2025, 100% bonus depreciation has been permanently restored, reversing the previous phase-out schedule. This allows investors to fully expense items with a useful life of 20 years or less in the first year.

-Cost segregation study: For commercial properties, a cost segregation study can reclassify certain building components, like electrical or plumbing systems, into shorter depreciation schedules (5, 7, or 15 years) instead of the standard 39 years. This front-loads deductions and is especially powerful when combined with 100% bonus depreciation.

-Section 179 deduction: Real estate operating businesses can also elect to immediately expense certain improvements, such as HVAC and security systems, up to a limit. For tax years beginning in 2025, the maximum deduction is $1.25 million, subject to a purchase limit of $3.13 million.

The key is acting now, not in January when the window has already closed. Remember, every property you acquire or improve before the ball drops isn’t just another investment—it’s a strategic tax play that can set you up for a stronger start in the new year.